Trading

The stock market does not know or care about your feelings or thoughts. However, stock traders are constantly distorting market information with their pre-existing beliefs. Winning a trade depends on both your prowess with numbers as well as controlling your emotions.

In this post, I am going to teach you about the psychological mindset of successful traders and how you too can develop one.

Trading Psychology of Successful Traders

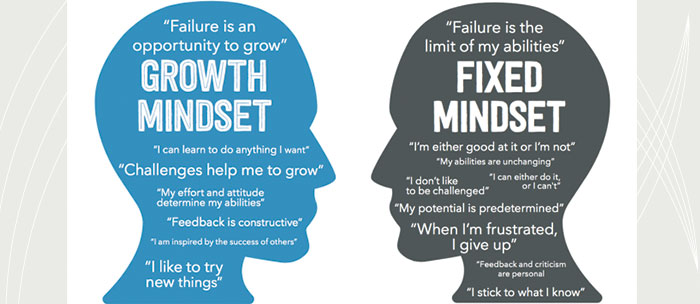

In General there are two types of Mindsit ich will show you now!

The term trading psychology refers to the state of mind that a trader is in while he or she is trading. If you are trading without the right trading mindset, the odds will be stacked up against you. Not only do you need to have sound technical analysis and a good fundamental analysis while trading, but you also ought to have the right mindset to boost your chances of success.

Having the right trading mindset helps you to be continually protected and improved throughout your entire trading career. Before you learn a trading strategy, the first thing you should do is to work on developing a positive mindset.

You need to eliminate emotions and biases that are in your mind in order to objectively know what the stock market is telling you. So how do you develop an open-minded conviction as a trader?

Get comfortable with taking risks

If you want to be a winning trader, you need to develop a high risk tolerance. You are going to lose money at some point in your trading life, which is why you should forget about searching for a trading system that offers a 70% strike rate.

Loss often generates powerful emotions like self-doubt, uncertainty, fear, and apprehension. However, winning traders understand that losing money is part of the game of trading, and the outcome of each trade is not known.

Always be ready to put your money on the line for potentially better results without letting fear of losing money put you on the sidelines. A winning trader is able to emotionally acknowledge that risk and reward go hand in hand in the world of trading.

Nonetheless, you also need to understand the importance of money management and take responsibility for managing your risks.

Don’t just place trades

A winning trader tends to take a break from trading when their results are poor. However, the trader doesn’t take a break from analyzing his/her results. You need to carefully figure out whether it is time to adopt another trading strategy or sit on the sidelines when your strategies fail to work.

So many losses are made because some traders just place trades without doing proper analysis. Don’t just guess at what to do. You need to have a sound reason for all the trades you place. That is what successful traders do!

Never stop learning

One of the most common things that winning traders do to improve their trading psychology is creating a great base of knowledge. Increasing your knowledge about how the world of trading works helps you make better decisions, both on the short and long-term. Getting to know about how trading works can help you react in a calm manner to the many curveballs that will cross your way in the course of trading.

Think of it this way: You would never take on a massive plumbing repair without learning about the potential things that could go wrong and what is involved with the job. You would have to do some research to prepare yourself for all possible outcomes. Similarly, winning traders educate themselves in order to make more informed decisions and minimize risks.

One way of educating yourself is by sticking with professions who understand how markets work. The skills and strategies that you are going to learn from them can help a great deal.

Knowledgeable traders also understand that importance of adjusting to changing market conditions. In short, they change their view on probable future movements in prices without dilly-dallying when markets indicate that they need to so.

Final Words

An improved trading psychology can have mind-blowing results on your trading career by helping you minimize impulsive actions and errors in judgment. Considering how you react when placing trades can help you get to know the triggers that prompt you to make poor decisions.

Once you become mindful of your emotional reactions and personal tendencies in trades, you will be able to identify shortcomings that often hold you back. You can then work on eradicating those emotionally reactive responses while trading, and develop a sturdier sense of steadiness.